Some Additional Insulin Facts:

The Role Of Pharmacy Benefit Managers

A definition you need to know for this section: insulin WAC is the wholesale acquisition cost, an estimate of the manufacturers list price for a drug to wholesalers or direct purchasers, that does not include discounts or rebates.

Speculated about for some time but difficult to prove because of private contracts is the sheer amount of cash being collected by PBMs. Originally created to help get needed drugs to patients more efficiently, PBMs have unfortunately become a key agitator to high out-of-pocket drug costs.

Page 5 of the report outlines the issue drug manufacturers increased insulin WAC, in part to give them room to offer larger rebates to PBM and health insurers, all in the hopes that their product would receive preferred formulary placement. This pricing strategy translated into higher sales volumes and revenue for manufacturers. In some cases, manufacturers appear to have been concerned that decreasing WAC prices would be viewed negatively by PBMs, since PBMs capture a portion of rebate revenue and are also paid administrative fees based on a percentage of WAC.

From the report, PBMs play a major role in the drug supply and payment chain by negotiating drug rebates and discounts with manufacturers and managing drug benefits for health care payers, including private insurers, employers, and entities that provide coverage under Medicare, Medicaid, and the Childrens Health Insurance Program .

The Role Of Insurance Companies

When negotiating with PBMs to create their insurance formularies, i.e. the products that they will provide insurance coverage for, insurance companies also receive portions of the drug rebates. Those rebates often go back to those enrolled under the insurance plans in the form of lower premiums. However, people who require maintenance medications like those for diabetes, asthma, etc. are the bulk of those paying for hefty rebates, while the rebates received by insurance companies themselves get spread amongst the entire population of those enrolled on a health insurance plan.

Over the last several years, further complicating privatized US healthcare, PBMs have merged with health insurance companies, further increasing their leverage, buying power, and ability to control the healthcare market. Express Scripts merged with Cigna, CVS Health with Caremark and Aetna, and Optum Rx became a subsidiary of UnitedHealth Group. These large mergers and acquisitions further complicate an already clunky system built more upon profit than patient care.

From the report, The Internal Revenue Service sought to address this issue in July 2019 when it released guidance that expanded the list of preventive services that an HDHP can cover below the deductible, to include insulin. However, this is a voluntary offering for HDHP plans it is up to the employer to decide if they want to offer this first dollar coverage , which creates an additional cost to the employer.

Also Check: Insulin Antagonist

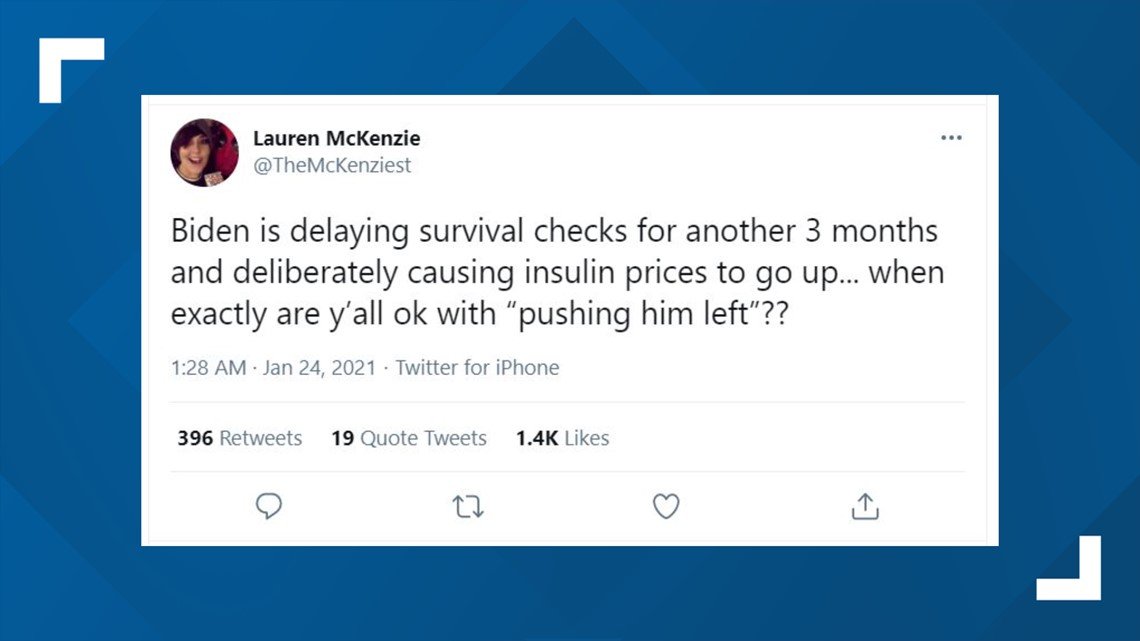

Pharma: Biden Freezes Trumps Lower Cost Insulin And Epinephrine Rule

Posted on 01/22/2021

Big pharma is smiling big right now. The big three insulin producers are Eli Lilly and Company, Novo Nordisk A/S, and Sanofi S.A., in which they dominate more than 90% of the world insulin market by value. After swearing-in, U.S. President Joe Bidens HHS froze the Trump administrations December 2020 drug policy that mandates community health centers to pass on all their insulin and epinephrine discount savings to patients.

The rule was finalized in late December 2020. The drug rule was put in place to benefit patients who have a hard time paying for expensive insulin and allergy medication. Former President Trump campaigned on lowering the price of important pharmaceutical drugs like insulin, which is used to treat diabetes, and epinephrine. Diabetes afflicts over a quarter of Medicare beneficiaries and drives billions in Medicare spending every year. More than 20 million Americans have diabetes, in which the body fails to properly use sugar from food due to insufficient insulin, a hormone produced in the pancreas.

Building A Unique Data Set Of Insulin Expenses

Due to lack of transparency in the system, the researchers had to leverage several sources to develop a data set that enabled them to map expenditure flows at each step in the distribution system. Sources included data from Medicare and Medicaid, Securities and Exchange Commission filings as well as state-level audit reports that were the result of state drug pricing transparency laws passed in recent years.

It is telling that we had to combine data from more than a dozen sources to understand expenditures on a single class of drug over a five-year period, said Ribero, research scientist at the USC Schaeffer Center.

You May Like: Metformin Most Common Side Effects

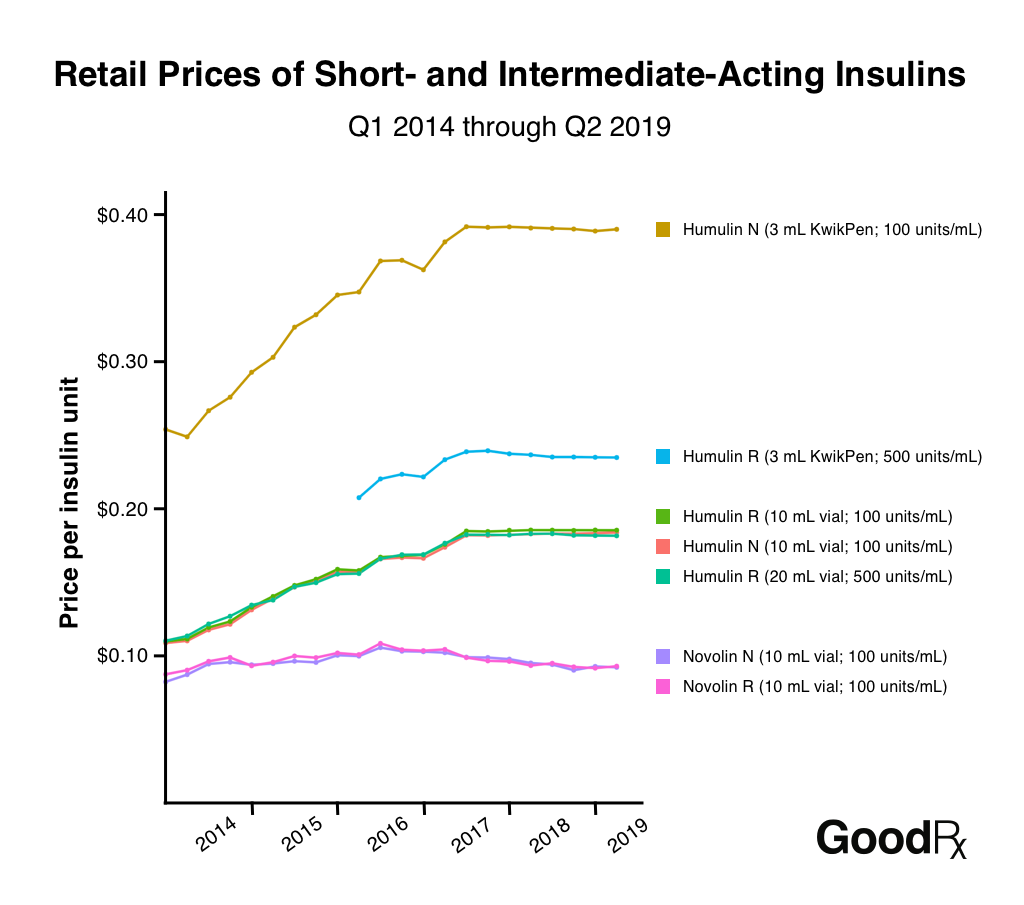

Insulin Costs For Us Patients Nearly Doubled From 2012 Through 2016 But Usage Was Flat

Twenty years ago, many of these products were so inexpensive the investment value just wasnt there for generics, said David Gaugh, senior vice president of sciences and regulatory affairs for the Association for Accessible Medicines.

That began to change in the last decade, around the same time drug makers started to spike their prices. In 2008, Humalog, Eli Lillys best-selling and most expensive insulin product, grossed more than $1 billion in U.S. sales 12 years after it hit the market. In 2017, Lilly sold $1.7 billion worth of the drug. The increased revenue in Lillys coffers was due largely to price increases, a fact Lilly admits over and over in its own annual reports to shareholders.

Today, there is just one copycat version of insulin and it is manufactured by Eli Lilly. The product, Basaglar, copies a pricey Sanofi product, Lantus, that is the worlds top-selling version of insulin. Its roughly 15 percent cheaper than Lantus.

There are other factors, too, that have deterred generics manufacturers that might otherwise have been interested.

Dr. Kasia Lipska, an assistant professor of medicine at Yale, told STAT that prescribing older insulin is to go against the tide.

This totally thwarts generic competition because if the off-patent drug is seen as already irrelevant, there is no impetus to invest in it, Lipska said.

Our Ruling: Missing Context

We rate this claim about the Biden administration’s action to be MISSING CONTEXT, based on our research. Some patients who use insulin and EpiPens the fraction who are served by federally qualified health centers may benefit from Trump’s order, but others could suffer if it results in decreased access for the centers to the 340B drug discount program. Also, the freeze through March 22 does not represent final action on the program, so it’s premature to call it a “reversal.”

Read Also: Type 1 Diabetes Tips And Tricks

How The Companies Justify Their Price Increases

With Type 1 diabetes, which affects about 5 percent of people with diabetes in the US, the immune system attacks the insulin-producing cells in the pancreas, leaving the body with little or none of the hormone. In Type 2 diabetes, the pancreas still makes insulin, but the body has grown resistant to its effects. In both cases, patients rely on insulin medication to keep energy from food flowing into their bodies.

The US is a global outlier on money spent on the drug, representing only 15 percent of the global insulin market and generating almost half of the pharmaceutical industrys insulin revenue. According to a recent study in JAMA Internal Medicine, in the 1990s Medicaid paid between $2.36 and $4.43 per unit of insulin by 2014, those prices more than tripled, depending on the formulation.

The doctors and researchers who study insulin say it is yet another example along with EpiPens and of companies raising the cost of their products because of the lax regulatory environment around drug pricing. They are doing it because they can, Jing Luo, a researcher at Brigham and Womens Hospital, told Vox in 2017, and its scary because it happens in all kinds of different drugs and drug classes.

In countries with single-payer health systems, governments exert much more influence over the entire health care process.

The US doesnt do that. Instead, America has long taken a free market approach to pharmaceuticals.

So Why The Price Change

One reason for higher pricing on these insulins are because of an annual tax on brand name pharmaceutical companies. This exempts generic drugs and was started in 2012 as part of the ACA . It originated as a $ 28 billion tax in 2012 and will grow to $40 billion in 2018 if left in place.

The drug companies Eli Lilly, Novo-Nordisk and Sanofi have Drug Savings Cards in place which allow patients who are qualified to decrease 30-day insulin supplies to $25.00 a month depending on the insulin.

Another reason for present higher costs is because brand names are coming off patent due to expiration. For example, the patent for Lantus came off patent in December, 2016. Patents for Humalog and Novolog, both rapid acting insulins, will expire soon too. These companies may keep present prices higher in anticipation of biosimilar insulins. A biosimilar insulin is made from the same protein structure and should have similar glucose lowering effects. Biosimilar insulins are subject to more stringent approval standards than small molecule regular generic drugs. Biosimilar insulins are more difficult to achieve a perfect copy than generic tablet drugs. The first biosimilar insulin called Abasaglar will be available in pen form around the end of December 2016. Everyone is interested in seeing how biosimilar insulins play out in terms of cost and effectiveness on blood sugars.

Also Check: Is Oatmeal Bad For Diabetics

Overall Insulin Epipen Pricing Isn’t Affected

Nationally, 30 million Americans suffer from diabetes, according to the American Diabetes Association. And nearly one in 50 Americans are at risk for anaphylaxis brought on by certain foods, insect bites, medications and latex, according to a 2013 study by the Asthma and Allergy Foundation of America.

But not all of those patients require insulin or epinephrine. And most who live in extreme poverty, or less than 200% of the federal poverty level an equation that works out to $34,840 for a family of two already receive free or discounted prescription drugs, a national health policy expert said.

Karyn Schwartz, a senior fellow at the Kaiser Family Foundation, a nonpartisan nonprofit that analyzes health policy, said some patients served by the 1,400 federally backed health centers nationally, such as those with high deductibles or those who are uninsured and paying list prices for the drugs, would have benefitted from the new pricing rule.

But it’s hard to say how many, she said. It’s also difficult to speculate about how many new patients would switch care to a community health center to take advantage of the discounted insulin and EpiPen prices, she said.

Rep Degette Newly Atop An Oversight Subcommittee Promises To Grill Drug Industry Ceos And Investigate Insulin Makers

While even the American Medical Association acknowledged in a recent policy statement that guidance and educational materials can help younger physicians become more comfortable with prescribing more affordable insulin alternatives, some doctors maintain that they shouldnt be blamed for the current insulin affordability crisis.

When we first starting using Humalog and Lantus, the difference between the two in terms of cost were minimal, but there were modest differences in hypoglycemia, Dr. Irl Hirsch, a professor of medicine at the University of Washington, told STAT. Since cost wasnt a big concern, how can one blame the physicians?

Branded drug makers deserve a share of the blame for the concentrated market, too.

Their strategy for keeping generic competition at bay? Filing patents lots of them. Each of the major manufacturers has hundreds of unexpired patents related to their products, the devices that deliver the drugs, and the methods for manufacturing them.

Sanofi, which manufactures Lantus, has been singled out in particular for allegedly repeatedly making small changes to its product to file for new patents. It has filed 74 patents on some version of that drug alone, according to I-MAK.

Also Check: Side Effects Of Glucotrol

How Rebates Most Of The Cost Of Your Insulin Work

The math is infuriating, but heres the heavily-simplified basics of how rebates work if you made a product for $5 and wanted to sell it, you may set the price at $10, to create a $5 profit. With that $5 profit, you can invest back in your company to create better products, pay yourself whatever you want to do with your $5.

But lets say you want your product to be in more places and available to more people. You might hire a middle person to place your product in new stores across the country, and theyll charge a fee, which is reasonable.

When you begin, their fee is $1. So that you can keep your $5 profit, you raise your price to $11. Still reasonable. But over time, your middle person makes themselves indispensable and knows it. Youre making way more money because of how many products youre able to sell, so youre not about to drop your middle person.

And oh oops you also signed a contract with your middle person to ensure youll always get your product placed in these nation-wide stores, so youre locked in. And part of that contract was an understanding that you wont lower your price, since that would impact your middle-persons profit.

So now, your product costs $50. Its the same product youve never improved it. Your customers are receiving no more value than when the product cost just $10. Over time, you wanted to make more money from it, so your profit is now $10.

Its still $5 to make your product.

Policy Recommendations To Bring Down Insulin Prices

Reed and DeGette in the report recommended 11 policy proposals to address the rising cost of insulin:

- Allow generic drugmakers to manufacturer older, off-patent versions of insulin

- Cap out-of-pocket costs for prescription drugs designed to treat chronic conditions

- Encourage the development of generic insulin products by addressing extensions on patents

- Link a patient’s out-of-pocket costs to negotiated prices instead of list prices

- Promote the development and use of value-based contracts between insulin makers and PBMs

- Promote the use of standardized fees and other payment arrangements instead of rebates between insulin makers and wholesalers

- Restrict the number of changes an insurer can make to a formulary each year

- Require insulin makers, PBMs, and health insurers disclose the value of rebates to other entities in the insulin supply chain

- Require manufacturers disclose how they determine the list price of insulin products

- Standardize the process for patients to challenge formulary restrictions and

- Standardize a process for drug formularies to disclose patient cost-sharing information .

Read Also: Which Blood Glucose Lowering Hormone Is Produced By The Pancreatic Islet Cells

Keep Reading For More Details

On January 20, 2021, the Biden administration announced a Regulatory Freeze Pending Review which states that any rules published in the Federal Register that had not yet taken effect would be postponed for 60 days to give the new administration an opportunity to review.

It is important to note that although Trumps Executive Order was published in the Federal Register on December 23, 2020, it had not yet been put into law. The order was not scheduled to go into effect until

Senators Press Insurers For Reams Of Pricing And Rebate Info On Insulin

The FDAs policy decrees that any insulin application thats still pending before the agency on March 20, 2020, will be rejected. Any applicant would then have to start over and reapply under a new biosimilar pathway.

Given the lengthy timeline for drug development along with an uncertain and often timely FDA approval process the hard stop in 2020 has made it dicey for drug makers to submit a potential generic insulin application for several years now.

Even companies who have insulin products in development and are ready to file their applications with the FDA are now waiting to apply until after 2020, given they want to avoid going through the time and money of applying in 2019, only to be rejected on the March 20, 2020, date, AAM explained to the FDA in March 2016.

he policy is already having a devastating effect on current development programs for many important protein products, including insulins, AAM wrote in its most recent letter to the FDA on the subject, adding that the policy conflicts with the relevant statutes, is arbitrary and capricious, words often used by companies to signal they will sue over a policy.

When it was first proposed, generic drug makers blasted the 2020 cliff, saying it would impair patient access to affordable alternatives to insulin and other drugs.

You May Like: Glucagon Stimulus

Big Pharma Hated Trump

Trumps most favored nation law seeks to lower prices in Medicare by linking the costs of certain medicines to cheaper prices in other developed countries. People often complain of buying the same drug in the U.S., when the price in Canada and Mexico are far cheaper. Obviously, the pharmaceutical industry strongly opposed the measure, arguing it would bring foreign price controls to the U.S. healthcare system and limit access. Groups including the Association of Community Cancer Centers and the Pharmaceutical Research and Manufacturers of America sued to block the rule. In December 2020, U.S. District Judge Catherine Blake issued a nationwide injunction on Trumps most favored nation drug pricing rule that would tie Medicare Part B drug prices to those paid in other wealthy countries starting January 1, 2021. The Trump administration also removed the gag clauses that prevented pharmacists from telling patients how to buy less expensive drugs. Apparently, pharmacists could not talk to patients about how to buy drugs.

This initiative could save the over 1.3 million seniors who rely on Medicare Part D plans and use insulin, an average of $446, or 66 percent, a year on their insulin costs. For those whose health, and even lives, depend on insulin, the savings will be nothing short of a godsend.